)

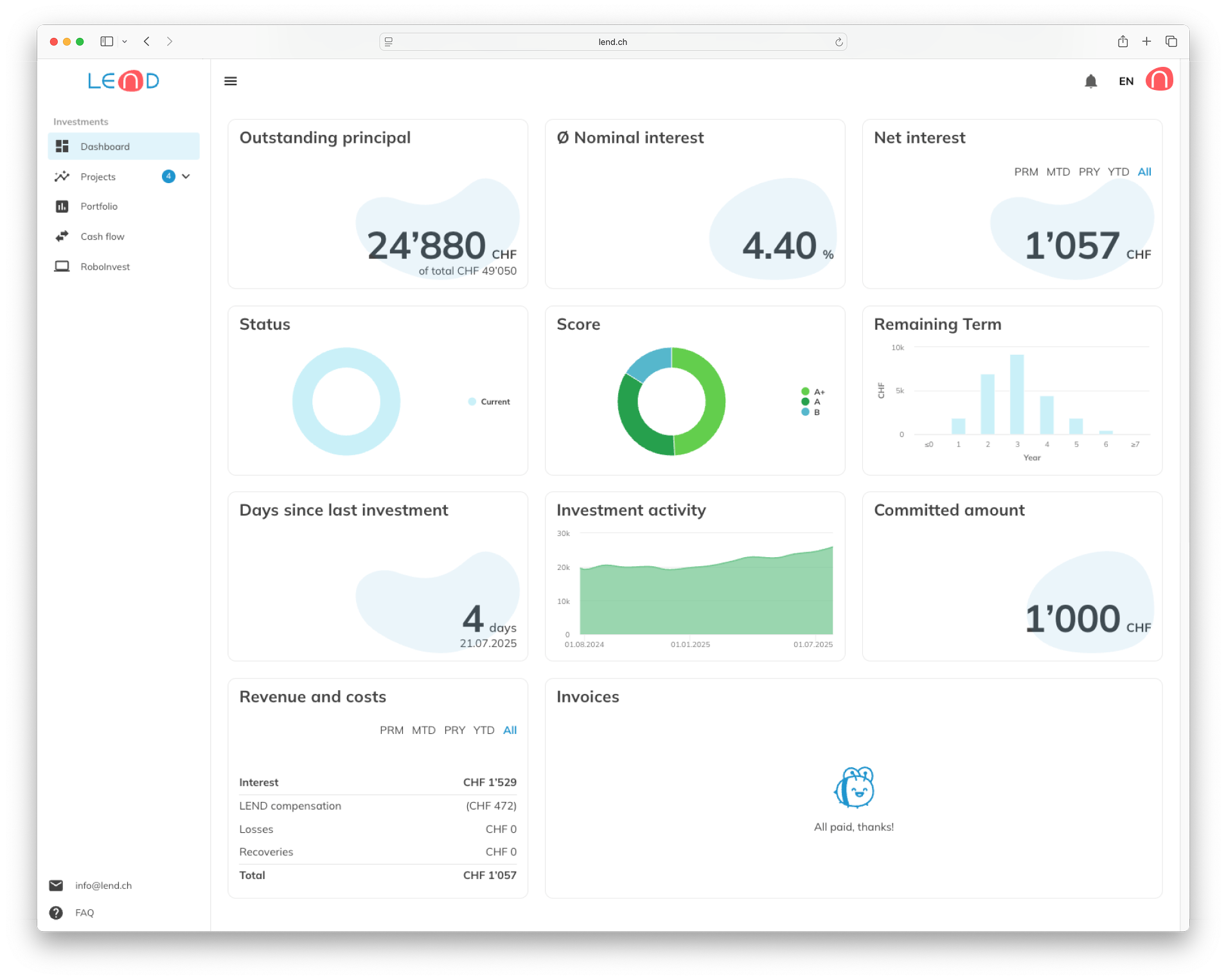

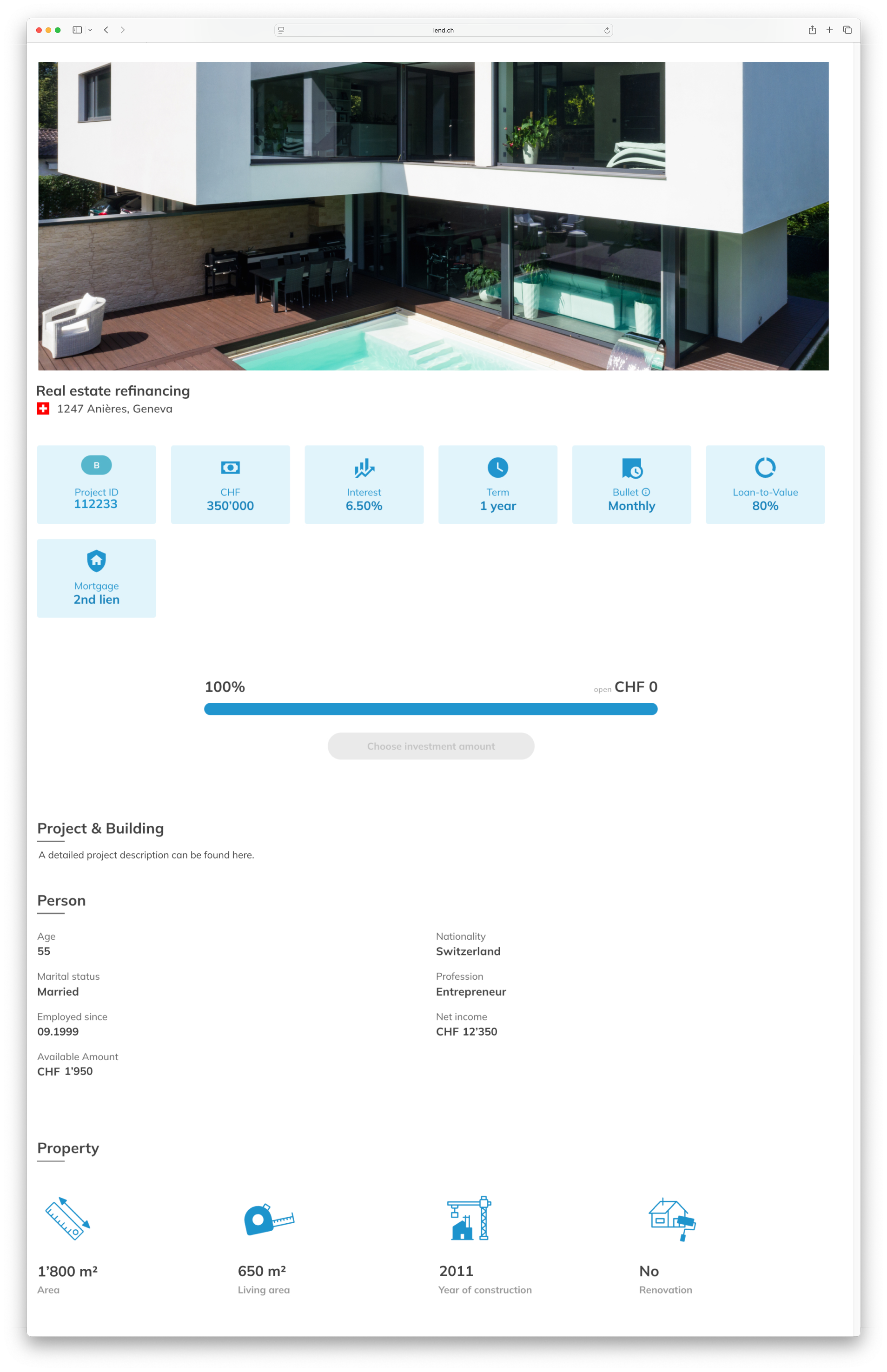

This is what it looks like after logging in: The investor dashboard and project overviews in the investor area

As an investor with LEND, you're diving into the world of crowdlending – an exciting way to invest your capital profitably. But how do you keep track of your investments, returns and the numerous loan projects? That's where your investor dashboard comes in, your central hub for all important information.

After logging in to our platform, you will find a clear summary of your portfolio and detailed information about each individual loan project.

Your investor dashboard: the cockpit for a complete overview

After logging in as an investor, you will be taken directly to your personal dashboard. This provides you with a quick overview of the status of your investments on LEND:

Outstanding principal: The amount currently tied up in ongoing loan projects.

Ø Nominal interest: Your average nominal interest rate for the invested projects per year in percent.

Net interest: Total net interest received to date in GBP (after deduction of fees).

Status: Status of your loan projects as a pie chart – any payment delays are displayed here.

Score: The score of the invested projects as a pie chart.

Remaining term: The remaining term of the invested projects by year as a bar chart.

Days since last investment: Shows when the last investment was made.

Investment activity: An overview of your capital employed over time.

Committed amount: Money that you have committed to loan projects but has not yet been paid out to the borrower.

Revenue and costs: A list of all your income and costs – filterable by PRM (previous month), MTD (month to date), PRY (previous year), YTD (year to date) and All (entire period since start of investment).

Invoices: Here you will find your open invoices.

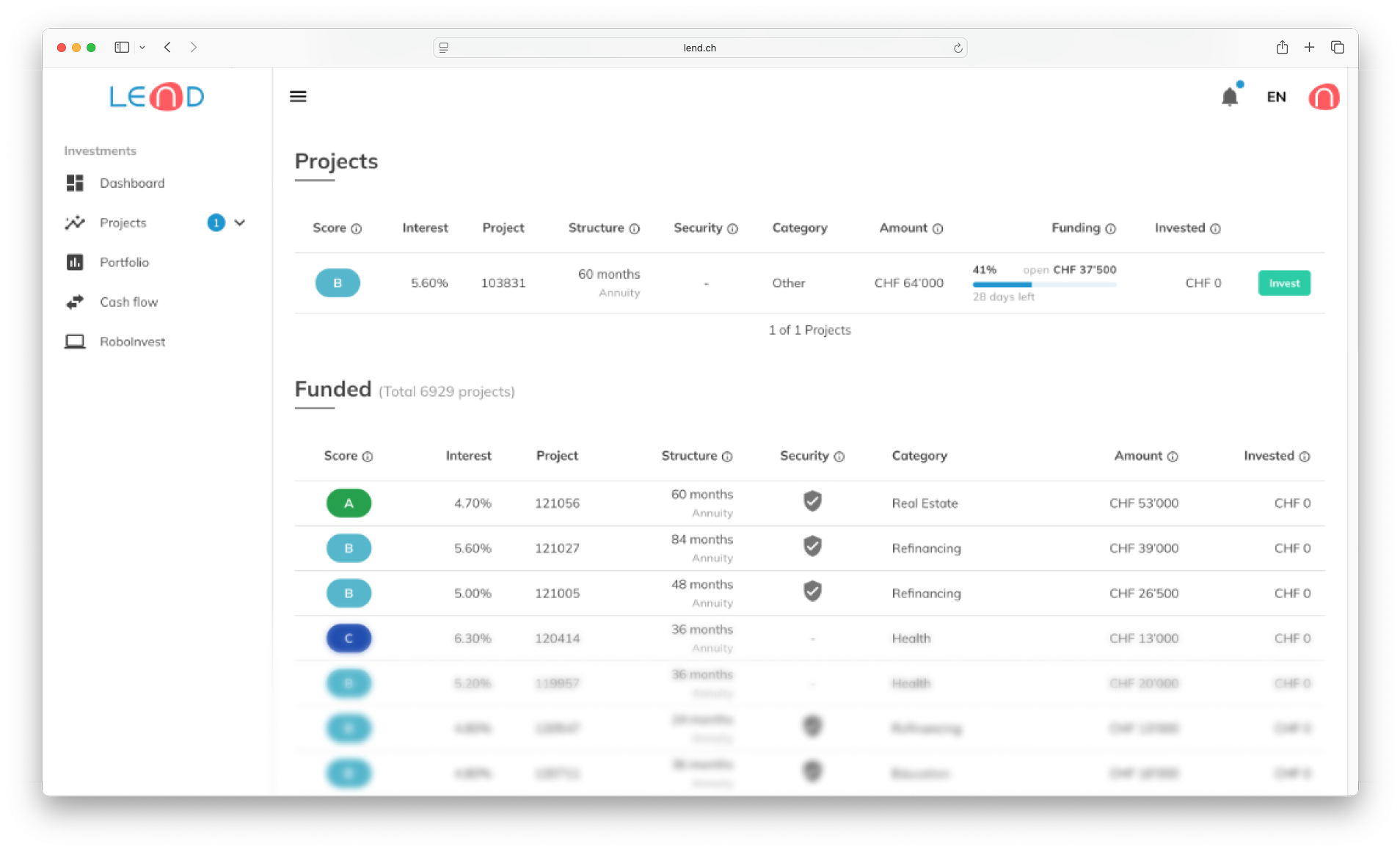

The project overview: data for an informed investment decision

The ‘Projects’ section is where you will find all the loan projects that you can currently invest in or that have already been fully financed. This section is divided into the product categories personal loans, business loans and mortgages – simply because we attach great importance to transparency and therefore provide you with different information for each category. This enables you to make an informed investment decision.

For each individual project offered for financing, you will usually receive the following basic information at a glance:

Loan amount

Interest

Project ID or name

Structure: Shows the contractual term of the loan and how repayment is agreed (annuity, linear or bullet)

Security: Indicates whether collateral has been provided. This includes payment default insurance, joint and several guarantees or real estate liens.

Category: Classifies the project into a category, e.g. ‘refinancing’, ‘car loan’, ‘liquidity generation’ or ‘current assets’.

Disclosure of how much has already been invested: (0–100%) and how much is still outstanding, if applicable.

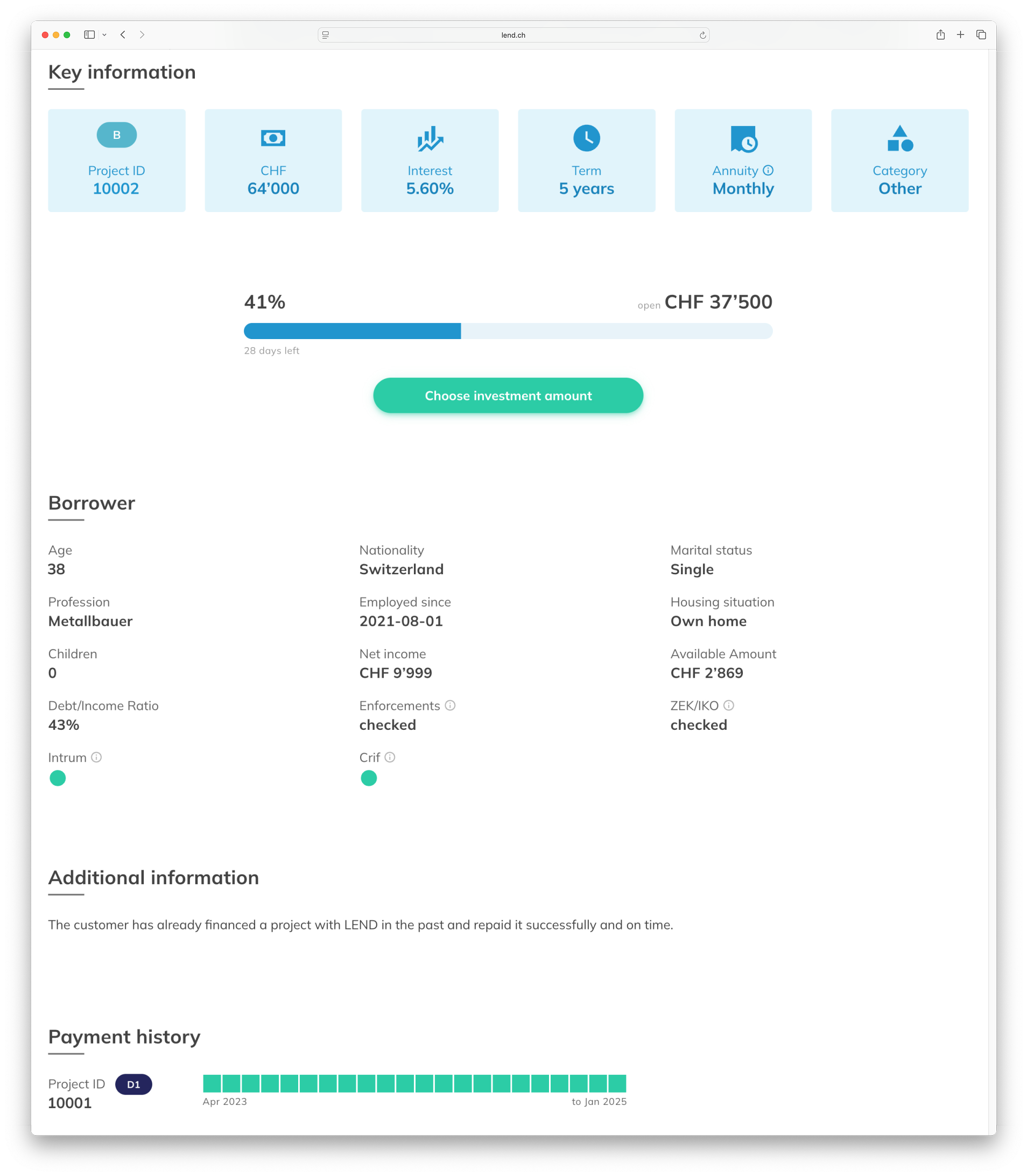

Project details: If you want to know exactly

Of course, you can also view each loan project in detail. In addition to the basic information mentioned above, we provide you with further information about the project and the borrower.

Additional information on ‘personal loans’:

Borrower information

Age

Nationality

Marital status

Profession

Employed since

Housing situation: Rented or owned property

Children

Net income

Available amount

Debt/Income ratio

Enforcements: We check the debt collection register and only accept borrowers who have no outstanding debt collection proceedings or outstanding loss certificates.

ZEK/IKO: All credit institutions in Switzerland are affiliated with the information centre for private loans, leasing and credit card transactions. Information on current and expired loans, including payment methods, as well as all approved and rejected loan applications is recorded there. This allows us to form a picture of the customer's credit history.

Intrum and Crif: These privately operated credit agencies provide information on the payment behaviour of private individuals and companies, in particular irregularities in the payment of invoices. They also calculate a probability of default for each private individual. ‘Green’ means low, “orange” means medium and ‘red’ means high.

Furthermore, we provide additional information, if available, such as whether the borrower has already had a loan with us or if we have further details about the purpose of the loan.

In ongoing credit projects, we also show the payment history of the current project and, if applicable, of the borrower's previous projects.

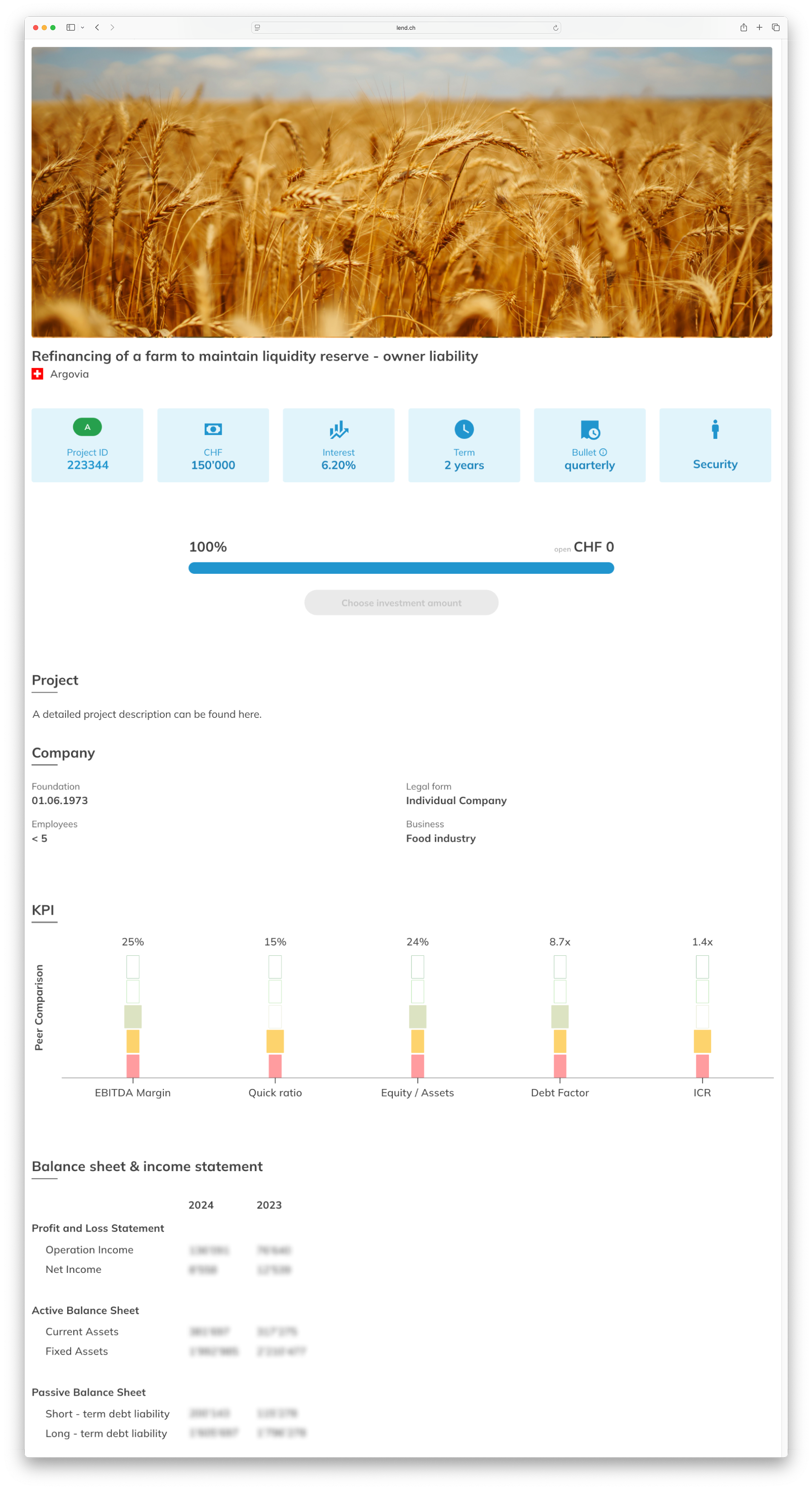

Additional data for ‘business loans’:

Project: This section provides a more detailed description of the capital requirements and background information on the company.

Company data:

Foundation

Legal form

Number of employees

Business

Key figures with peer comparison, e.g.

EBITDA margin

Quick ratio

Equity / Assets

Debt factor

Interest coverage ratio

Balance sheet & income statement

Payment history

Additional data for ‘mortgage’

Photos: Normally, several photos of the property are stored in the project.

Security: Detailed information on the collateral underlying the mortgage.

Loan-to-value: This value indicates the proportion of a property that is financed by external funds.

Project & building: A detailed description of the project and the property.

Person

Age

Nationality

Marital status

Profession

Employed since

Net income

Available amount

Property

Area

Living area

Year of construction

Renovation: Yes / No

Why is this information important to you?

The wealth of data available allows you to make an informed decision as to whether a project fits your risk profile and return expectations. By investing in different projects with different risk classes, terms and borrower profiles, you can diversify your portfolio and spread the risk.

We have also summarised the advantages of investing in the Swiss credit market and how you can build up passive income here in our blog.

Interested in investing with LEND? Then sign up now as an investor and take a look at the current projects in the login area.